$8–11M HVAC Exits: Why Private Equity Is Buying Up the Trades in 2025

Private equity is flooding HVAC. With 8–11x EBITDA multiples and $10M+ exits, 2025 is peak M&A season. But 3x price hikes and staff cuts follow. Learn the playbook to maximize valuation and protect your legacy.

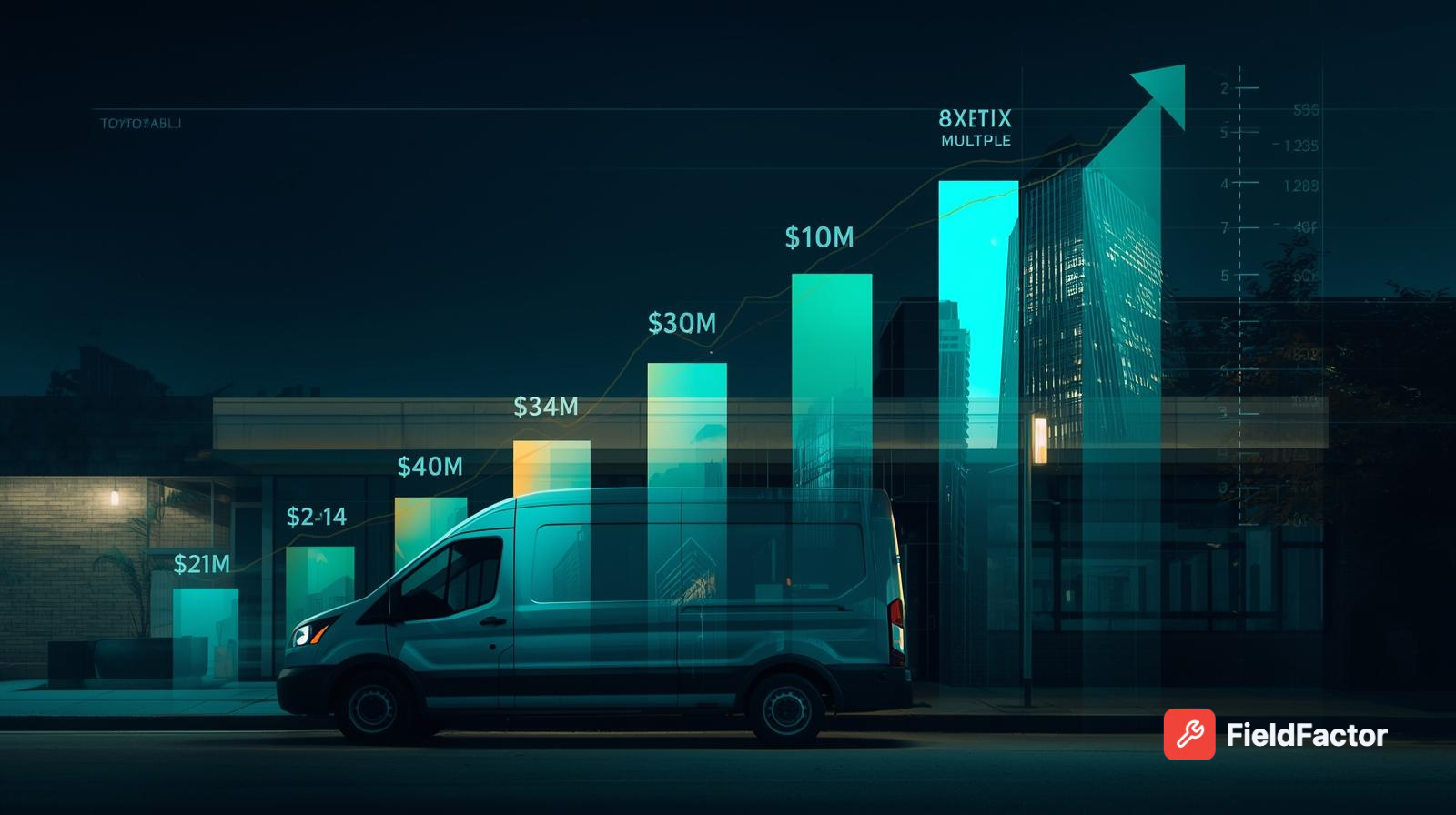

The HVAC services sector is a private equity (PE) magnet: A $216 billion global market exploding to $390 billion by 2033 at a 7.5% CAGR, with U.S. services alone at $50 billion and fragmentation (29,000+ players) fueling roll-ups amid a 110,000-technician shortage. In 2025, PE activity is red-hot: 77 M&A deals announced or completed year-to-date (up from 76 in 2024), with platforms like Apex Service Partners snapping 20+ tuck-ins annually and mega-deals like Goldman Sachs' $1.7B Sila buyout setting the tone. For owners, PE isn't abstract—it's liquidity (8-11x EBITDA multiples, $10M+ exits for $1-2M EBITDA platforms), operational rocket fuel (20-30% EBITDA lifts via synergies), and a second bite at the apple (10x strategic exits in 3-5 years). But the flip side? PE playbooks often triple prices, train techs to push financing, and slash headcount—ruining local vibes, as one X user vented: "Every HVAC clinic ruined by PE—prices up 3x, service down."

This 2025 guide—sourced from Capstone's Q2 update (77 deals YTD), First Page Sage's multiples report (Q3 2022-Q1 2025: 3.12x median EBITDA for <$1M), and Grata's PE Playbook (top 10 firms like Morgan Stanley at 8-11x)—equips owners: Valuation deep dive (SDE 2.08x-6.11x, revenue 0.3x-1.4x), acquisition playbook (90-day diligence), PE impact (pros: $6B exits via roll-ups; cons: 3-5x price hikes), trends (ESG/green subsidies +20% multiples), and prep tips (systemize for 25% premium). In a frenzy (e.g., Palladin's Southeast Mechanical tuck-in), PE's your exit accelerator—or a cautionary tale. Know the game; play to win.

The PE Frenzy in HVAC: Why 2025 is Peak Roll-Up Season

PE's HVAC obsession? Recession-proof recurring revenue (40%+ from maintenance), low capex, and endless tuck-ins in a fragmented market—138 deals in 2024 alone, up 6% YTD 2025 to 77. Platforms start at $1-2M EBITDA ($10M+ rev), acquiring 10-30 add-ons over 3-5 years for 10x exits to strategics like Carrier. X Buzz: "PE HVAC roll-up: $4M tuck at 8x, scale to $6B exit—$500k seed to millions." (Jun 2025).

2025 PE Activity Snapshot

| Metric | 2024 Full Year | 2025 YTD (Q3) | Key Deals | Notes |

|---|---|---|---|---|

| Deals | 138 | 77 (up 1.3%) | Goldman Sachs Sila ($1.7B); Palladin Southeast Mechanical | Services lead (residential 40%). |

| Platforms | $10M+ EBITDA | $5-20M targets | Limbach Consolidated Mechanical | 20-30 tuck-ins/3-5 yrs. |

| Dry Powder | $10B+ | $12B+ | Morgan Stanley, Alpine | ESG/green focus +20% multiples. |

*Sources: Capstone Q2 2025, Origin Q1 Review.

Valuation 101: How PE Values Your HVAC Business in 2025

PE buys cash flow: EBITDA multiples dominate (3-6x for <$1M EBITDA, 6-10x for $1-5M), with SDE (Seller's Discretionary Earnings) at 2.08x-6.11x for smaller shops and revenue 0.3x-1.4x as a backstop. For a $1M EBITDA platform? $8-11M entry, scaling to $60M+ exit. 2025 twist: Recurring revenue (40%+) adds 1-2x; ESG compliance (green retrofits) +20%.

HVAC Valuation Multiples: 2025 Benchmarks

| Metric | Median Multiple | Range | Key Drivers | Example |

|---|---|---|---|---|

| EBITDA | 3.12x (<$1M) to 6-10x ($1-5M) | 2.08x-11x | Recurring (40%+ = +1-2x); Growth 20% YoY | $1M EBITDA = $8-11M. |

| SDE | 4x | 2.08x-6.11x | Owner-dependent ops (-1x if key-man risk) | $500k SDE = $2-3M. |

| Revenue | 0.9x | 0.3x-1.4x | Services > products (1.2x vs. 0.6x) | $5M rev = $4.5-7M. |

*Sources: First Page Sage Q1 2025, Axial/QuickRead.

Valuation Formula: Enterprise Value = EBITDA × Multiple + Adjustments (e.g., +20% for 40% recurring). Prep tip: Systemize ops for +25% premium.

The Acquisition Playbook: From Teaser to Close in 90-180 Days

PE acquisitions follow a 90-180 day sprint: LOI to wire, with 72% add-ons (tuck-ins) vs. 28% platforms.

2025 Acquisition Timeline

| Phase | Duration | Key Steps | Owner Tips |

|---|---|---|---|

| Teaser/LOI | 2-4 weeks | CIM (Confidential Info Memo); NDA/LOI (non-binding) | Highlight recurring (40%+ = +1x multiple). |

| Due Diligence | 4-8 weeks | Financials, ops audit, legal (72% add-ons focus) | Clean books; Systemize for 25% premium. |

| Closing | 2-4 weeks | SPA (Sale Agreement), wire funds; Earnouts (20-30%) | Negotiate rollover (20% equity for second bite). |

*Sources: Origin Q1 2025, Capstone Q2. Diligence red flags: Owner dependency (-2x multiple).

The PE Impact: Pros, Cons, and the Owner's Playbook

PE's double-edged: $500k seed to $6B exit via roll-ups, but post-acquisition playbooks triple prices and cut staff—ruining local service, as PHCC warned in September 2025: "PE's get lost—focus on owners."

Pros and Cons: PE Acquisition for HVAC Owners

| Pros | Impact | Cons | Impact |

|---|---|---|---|

| Liquidity | 100% cash-out ($8-11M for $1M EBITDA) | Loss of Control | PE playbook: 3x prices, financing push—customer backlash. |

| Growth Capital | 20-30 tuck-ins, $6B exit potential | Cultural Shift | Staff cuts, metrics obsession—30% turnover spike. |

| Expertise | Ops tweaks (AI dispatch +35% efficiency) | Earnouts | 20-30% tied to performance; Disputes common. |

*Sources: Grata Playbook, Forbes Sep 2025.

X Warning: "PE HVAC acquisition: $4M tuck, but prices 3x, techs quit—ruined the biz." (Jul 2025).

2025 Trends: ESG, Tech, and the PE-HVAC Collision

- ESG Premium: Green retrofits/subsidies add 20% multiples; 90% HFC cut by 2030 favors compliant shops.

- Tech Roll-Ups: AI dispatch (35% gains) in platforms; PE pours into software (ServiceTitan integrations).

- Backlash Wave: PHCC's "PE get lost" echoes X: Acquisitions ruin clinics (prices up 3-5x).

Case Studies: HVAC PE Wins (and Warnings) in 2025

- Goldman Sachs Sila ($1.7B): 30+ locations, 10x growth—owners rolled 20% for second bite.

- Palladin Southeast Mechanical: Tuck-in added synergies; 20% EBITDA lift, but staff cuts sparked backlash.

- Limbach Consolidated: $200M entity; ESG focus +25% multiple, but price hikes drew X ire ("PE ruined my HVAC").

Owner Prep: Maximize Your PE Valuation and Exit in 2025

- Systemize Ops: SOPs for 25% premium; Recurring 40%+ = +1-2x.

- Clean Financials: Normalize EBITDA (add-backs 20%); Aim 15% margins.

- Hire Advisor: M&A firm for 10% fee; Target 8-11x.

- Negotiate Smart: 20% rollover, cap earnouts at 20%; ESG audit +20%.

Conclusion: PE's HVAC Wave—Ride It for 8-11x Exits, But Know the Playbook

In 2025's 77-deal frenzy, PE offers $8-11M liquidity for $1M EBITDA shops, but watch the playbook: 3x prices, staff tweaks, and cultural shifts. Prep with recurring revenue and systemization for 25% premiums—your $1M milestone becomes a $10M legacy. Download our free Valuation Checklist—what's your exit timeline? Comment below.