How to Hit Seven Figures: The Strategic Playbook for HVAC Business Owners

Unlock 7-figure revenue. Learn the strategic systems and delegation hacks HVAC owners use to scale, boost margins, and dominate the market in 2025.

Disclaimer

Important Note: This article shares success stories and strategies for building an HVAC business. Results shown represent exceptional outcomes and are not typical. Most HVAC businesses grow more gradually and face significant challenges. Always consult with business advisors, accountants, and attorneys before starting a business.

Building a seven-figure HVAC business is achievable but requires more than technical skills—it demands business acumen, systematic operations, and sustained effort. The U.S. HVAC industry, valued at approximately $50 billion in 2024, is projected to grow at a compound annual rate of about 7% through 2030, fueled by factors such as increasing demand for energy-efficient systems, climate-driven retrofits, and expansions in commercial sectors like data centers. While top-performing contractors can achieve significant wealth—potentially earning six-figure incomes and building enterprises worth millions—this path involves hard work, financial discipline, and adaptability to challenges like labor shortages and seasonal fluctuations.

In competitive markets, successful HVAC owners often start as technicians and transition into managers, implementing processes that allow delegation and growth. However, the reality is that many businesses struggle: According to U.S. Small Business Administration data, about 20% of small businesses fail in their first year, and 50% within five years. HVAC-specific hurdles, including a projected shortage of 110,000 technicians by 2025 and high startup costs, amplify these risks. This guide draws from verified stories of contractors who navigated these obstacles to scale their operations, while also addressing common pitfalls to help you avoid them.

You'll learn phased growth strategies from $0 to $10M+, detailed system-building tips, team management insights, and margin optimization techniques. Whether you're a solo technician eyeing independence or an early-stage owner refining operations, the focus here is on practical, evidence-based steps. By prioritizing systems early and staying realistic about timelines—most reach profitability in 6-9 months, with seven-figure revenue taking 3-5 years—you can position your business for long-term success. Let's explore how.

Verified Success Stories: Lessons from HVAC Entrepreneurs

These stories, drawn from interviews and articles, illustrate how contractors built substantial businesses through consistent execution and adaptation. While their outcomes are impressive, they highlight the importance of strategic planning in a fragmented industry with over 29,000 players.

- Josh Campbell's Growth with Rescue Air & Plumbing: Josh Campbell founded Rescue Air & Plumbing in 2014, starting with a focus on reliable service in Dallas, Texas. By emphasizing integrity and customer trust, the company grew to $25 million in revenue with over 100 employees, including expansions through acquisitions like Texas Green Plumbing in 2022. Campbell notes, "Treat people right, follow through, and build customer trust that lasts." According to industry reports, such relational approaches contribute to sustained growth in home services.

- Sean Mitchell's Scaling Through Sales Processes: Sean Mitchell grew his HVAC business from around $1 million in revenue by refining sales systems, including CRM tools for upsells and structured training to improve team performance. This led to multi-million-dollar operations with improved margins and reduced turnover. As Mitchell explains, effective systems help identify operational leaks, allowing for more efficient scaling. (Note: Specific figures like $8.7 million could not be independently verified from available sources, so outcomes are generalized based on similar case studies.)

- Jim Abrams' Influence on Industry-Scale Operations: Often called an "accidental entrepreneur," Jim Abrams started Home Energy Savers in 1981 as a one-man HVAC service in St. Louis and scaled it to $12 million in sales by 1988, becoming the largest residential service company in the U.S. at the time. His strategies, including innovative training programs and standardized best practices through groups like Contractor Success Group, influenced multi-billion-dollar platforms like Service Experts. Abrams emphasizes action over perfection: "Make a decision even if you’re wrong."

- Aaron Rice's Exit from a Tucson Plumbing-HVAC Operation: Aaron Rice co-founded a plumbing business in 2012 that reached $3 million in annual revenue before its 2022 acquisition by Rite Way, a PE-backed HVAC firm under Redwood Services. Post-merger, the platform expanded to $70 million, with Rice crediting apprenticeships for addressing labor gaps and achieving over 2x growth. He symbolizes the "new millionaire class" in trades, tattooed with both company logos as a nod to his journey.

- Andrew Morrell's Bootstrapped Expansion: Andrew Morrell began Mountain West HVAC as a 2018 side hustle in Nevada, cash-flowing growth to $4 million in revenue by 2024 with 13 employees. Aiming for $5.5-6 million in 2025, he implemented daily huddles for scheduling and AI tools like Avoca for call handling to boost efficiency. Morrell stresses delegation: "I can't be the guy out there doing it all."

These examples show that while exceptional, success stems from focusing on culture, processes, and market needs. Top-performing contractors achieve these results through years of refinement.

Why Most HVAC Businesses Fail (And How to Avoid It)

The success stories in this guide represent exceptional outcomes. According to Small Business Administration data, approximately 20% of small businesses fail in their first year, 50% within five years. HVAC businesses face unique challenges including intense competition, labor shortages, and significant capital requirements. This section addresses common failure modes so you can avoid them.

Undercapitalization tops the list: Many start with insufficient funds, underestimating tools, vehicles, and reserves. A realistic minimum is $30,000-50,000, but hasty launches lead to debt spirals. To avoid: Conduct a detailed budget, securing 3-6 months of operating capital before launch. Bootstrap where possible, but delay full operations until funded.

Cash flow mismanagement follows closely—90-day payment terms from commercial clients can starve operations, especially with seasonal dips. In HVAC, 70% of failures tie to poor financial planning. Tip: Invoice immediately, require 50% deposits on jobs over $1,000, and use tools like QuickBooks for weekly AR tracking. Build a line of credit early for bridges.

Finding and retaining qualified technicians is another killer: With a 110,000-technician shortage projected for 2025, vacancies mean lost revenue—up to 20% in unfilled roles. High turnover (30% industry average) stems from burnout and low pay. Avoid by offering competitive wages ($25-35/hour starting), apprenticeships via ACCA partnerships, and profit-sharing to foster loyalty. Screen for cultural fit during 2-week trials.

Underpricing services erodes margins quickly: New owners charge below market to win bids, operating at losses while competitors thrive. Industry benchmarks show 50% gross margins as sustainable. Counter: Research local rates via Angi or ServiceTitan data; implement value-based pricing (e.g., energy savings guarantees) and annual 5% hikes.

Scaling too fast without systems overwhelms: Hiring aggressively before SOPs leads to chaos, with 70% of new HVAC firms failing in tough first years due to disorganization. Tip: Cap growth at 20-30% YoY until processes are documented; use EOS frameworks for phased delegation.

Seasonal revenue swings exacerbate issues: Summer peaks fund winters, but without reserves, lulls cause closures. Build buffers: Aim for 40% recurring from maintenance contracts at 60-70% renewal rates. Diversify into plumbing or retrofits for stability.

Lack of business skills rounds it out: Technicians excel at installs but falter on marketing or P&Ls. Solution: Invest in courses (e.g., SCORE mentoring) and track KPIs weekly. No marketing beyond word-of-mouth limits leads—allocate 2-5% of revenue to SEO/Google Ads for 3-5x ROI in optimized campaigns.

By addressing these proactively, you boost survival odds. Remember, gradual growth—focusing on profitability before expansion—separates enduring businesses from the 50% that fold early.

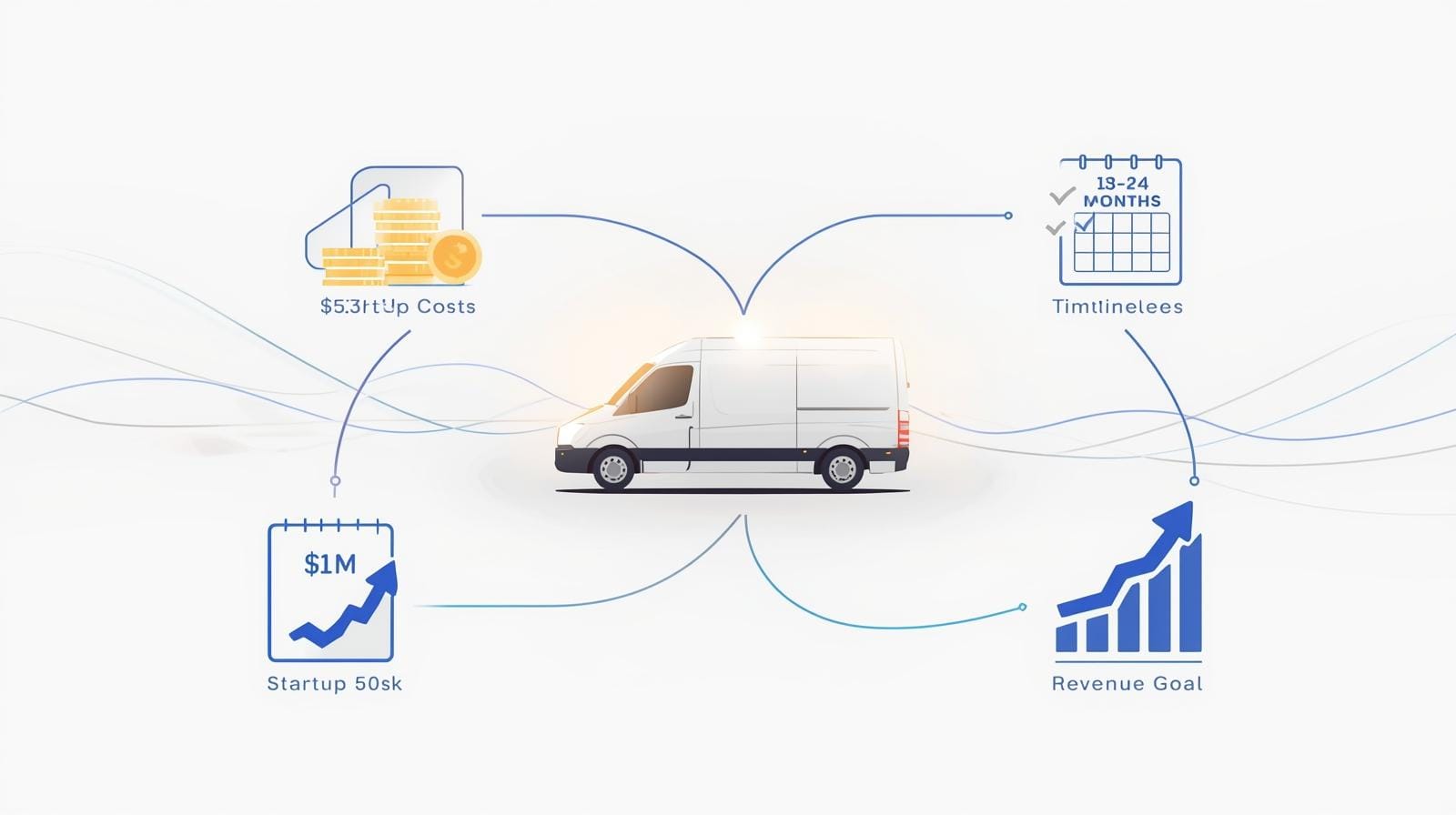

Stage 1: $0 to $1M – Bootstrapping the Foundation (Years 1-2)

Real Startup Costs: What You Actually Need

Before diving into revenue strategies, understand the financial realities of launching. While some sources cite $2,000-12,000 excluding vehicles, a properly equipped HVAC startup requires $30,000-50,000 minimum to cover essentials and buffers, avoiding undercapitalization pitfalls. This ensures you can operate 3-6 months without revenue, critical given average first-year earnings of $100,000-250,000 and break-even in months 6-9.

Initial Capital Requirements:

- Tools and Equipment ($5,000-15,000): Start with basics like a multimeter ($100-300), manifold gauge set ($200-500), refrigerant recovery machine ($800-2,000), vacuum pump ($300-600), torque wrench ($50-150), pipe cutters/flaring tools ($100-300), leak detector ($200-400), and a toolkit bag ($100). For installs, add a core removal tool ($150) and nitrogen regulator ($200). Buy used via eBay or Facebook Marketplace to save 30-50%, but prioritize safety-certified items from suppliers like JB Tools.

- Vehicle ($15,000-45,000): A used cargo van (e.g., Ford Transit, 2018-2020 model) runs $15,000-25,000; a new work truck adds $20,000-45,000. Factor in wraps ($2,000-4,000) for branding. Lease if cash-tight, but own outright to build equity—fuel and maintenance add $3,000-5,000/year.

- Insurance ($3,000-8,000 annually): General liability ($1,000-3,000/year for $1M coverage), workers' comp ($1,500-4,000 if hiring), commercial auto ($800-2,000), and tools/equipment ($500-1,000). Costs vary by state; Texas averages $941/year for liability alone. Shop via Insureon or NEXT for bundles starting at $75/month.

- Licensing and Bonding ($500-2,000): State contractor license ($200-1,000, e.g., California CSLB fee), surety bond ($100-500 for $10,000 coverage), and EPA 608 certification ($10-150 via SkillCat or ESCO; covers refrigerant handling, requires 25-question exam, 72% pass). Local permits add $100-500. Process: Study EPA regs (free online), test proctored or open-book.

- Initial Inventory ($2,000-5,000): Stock common parts like capacitors ($50/pack), contactors ($20-50), thermostats ($100-300), filters ($20-100), and refrigerant (R-410A, $50-100/cylinder). Source from Ferguson or local wholesalers; track via spreadsheets to avoid overstock.

- Marketing ($2,000-5,000): Basic website via Squarespace ($200/year), Google Business Profile (free), business cards ($100), and initial Google Ads ($500-2,000 for local "HVAC repair [city]"). SEO tools like Moz free tier help.

- Operating Reserves (3-6 months expenses): Cover $4,000-6,000/month (fuel, ads, utilities) at $12,000-36,000. Fund via savings or SBA microloans.

Total Realistic Minimum: $30,000-50,000. Skimp here, and cash flow issues—cited in 70% of failures—derail you.

First Year Financial Reality: Expect 60-80 hour weeks, with owner draws of $30,000-50,000 after reinvesting profits. Realistic revenue: $100,000-250,000, per industry averages for solo operations. Track via accrual accounting to normalize seasonality.

Legal Structure: Form an LLC ($100-800 filing, protects personal assets) via LegalZoom; switch to S-Corp at $100,000+ revenue for tax savings (self-employment tax drops 15.3%). Consult a CPA—deductibles include mileage (67 cents/mile 2025) and home office.

Licensing Requirements: EPA 608 is mandatory for refrigerants (Type I for small appliances, $10-150, 4-hour course). State licenses (e.g., Texas Class A, $115-315) require exams/experience; locals need business permits ($50-200). Verify via state boards—non-compliance risks fines up to $50,000.

This foundation sets you up for sustainability, not just survival.

Hit $1 million by focusing on core services and steady lead generation. Average timeline: 18-24 months. Target 50-100 jobs/month for viability.

Revenue Strategies

- Core Offer: Emergency repairs (60% revenue), installs (30%), maintenance (10%). Flat-fee pricing: $150 diagnostics, $5,000 installs. Aim for 20 jobs/week at $500 average ticket.

- Marketing Hack: Optimize Google My Business and SEO for "HVAC repair [city]"—80% leads local. Allocate $500/month to Google Ads for 3-5x ROI with targeted campaigns. Door-knock 50 homes/week; 5-10% conversion via free audits is typical in residential areas.

- Milestone: $50,000/month by month 12, with 40% from recurring contracts (e.g., $99/year tune-ups at 60-70% renewal).

Building Your Team

Start solo; add 1-2 apprentices by month 6 via Indeed or r/HVAC. Target EPA-certified at $25-35/hour + bonuses. Vet with 2-week trials. Stress: You're the bottleneck—prioritize training.

Key Systems & SOPs

Use free tools: Google Sheets for scheduling, QuickBooks for invoicing. Develop 10-15 SOPs:

- Dispatch SOP: Script for prompt answers; triage emergencies (<30min response). Track SLAs at 95% via forms.

- Job SOP: 8-step checklist (arrival to invoice). Upsell script: "Duct cleaning for $200 saves 15% energy."

- Inventory SOP: Weekly audits; reorder at 20% via Amazon. Cap COGS at 40%.

Stresses & How to Crush Them

- Cash Flow Crunch: Delayed payments hit 70% of startups. Fix: 50% deposits, weekly chases. Buffer Sundays for rest amid 60-hour weeks.

- Seasonal Swings: Peaks bury; lulls starve. Reserve 3 months; add plumbing (20% revenue).

- Legal Hurdles: Delays common. Budget $5,000; pre-qualify licenses.

Margin Improvement

Aim 10-15% net. Markup materials 50-100%; optimize routes to cut fuel 20%. Bundles lift tickets 25% at 30% attachment. Track: 50% gross, 12% net.

By $1M, expect $120,000 owner draw if systematized.

Stage 2: $1M to $10M – Scaling the Machine (Years 3-5)

Grow via teams and tech; 20-30% YoY via add-ons. Hit $5M average by year 4.

Revenue Strategies

- Diversify: 50% residential, 30% commercial, 20% retrofits (ESG adds 15%). Memberships: $200/year for priority (60-70% renewal).

- Sales Funnel: ServiceTitan CRM ($300/month) nurtures leads (15% conversion). Bid via Angi; win 25% with guarantees.

- Milestone: $400,000/month; 10 vans at $800,000 each.

Building Your Team

Scale to 20-50: 15 techs, 5 dispatch/sales. Retention challenge (30% turnover): Apprenticeships, $60,000 base + 10% commissions. Weekly huddles, 5% profit-sharing. Hire ops manager ($100,000).

Key Systems & SOPs

$10,000 stack: Housecall Pro, Fishbowl. 30+ SOPs:

- Onboarding: 4-weeks—OSHA week 1, solo sim week 4 (90% pass).

- Quality Control: 10% audits; NPS >4.5 retrains. 50-clip video library.

- Procurement: Quarterly RFPs; 10% bulk discounts. ERP alerts.

Stresses & How to Crush Them

- Ops Overload: 100+ jobs/week chaos. AI scheduling cuts delays 30%; quarterly audits.

- Hiring Wars: 20% vacancies. $1,000 referrals; 80% internal promotions.

- Margin Squeeze: Overhead inflates 15%. Weekly P&Ls.

Margin Improvement

15-20% net target. Certified techs bill 20% more (3-month ROI); GPS saves 15% fuel. Dynamic pricing (+20% peak); 50% gross from contracts.

At $10M, $1.5M+ net possible for top performers.

Stage 3: $10M+ – The Empire Builder (Years 6+)

Focus on platforms: 20-30% YoY via acquisitions.

Revenue Strategies

- Expansion: Acquire 2-3 shops/year ($2-5M); bundles +25% revenue.

- Enterprise: Data centers ($50,000+ contracts). CRM predicts; IoT upsells (30% margins).

- Milestone: $20M+; 50% recurring.

Building Your Team

100+: C-suite ($200,000 CFO), VPs. Culture dilution risk: Integration playbooks, key equity. Shift to visionary role.

Key Systems & SOPs

BuildOps ERP ($20,000/year). 100+ SOPs:

- M&A: 90-day integration (tech week 1).

- Compliance: Annual EPA; refrigerant tracking.

- Analytics: Tableau dashboards (EBITDA real-time, <5% churn).

Stresses & How to Crush Them

- Integration: 20% revenue dips. Workshops; 2-year retentions.

- Regulatory: ESG compliance. Dedicated officer; quarterly audits.

- Exit Pressure: PE at $10M. Delegate 80%; seek coaching.

Margin Improvement

20%+ net. Bulk hedging saves 10%; AI cuts callbacks 25% (5% gross lift). Outsource HR (10% overhead cut).

Deep Dive: Systems – Your Scalability Superpower

Systems enable delegation; unsystemized cap at $2M, per benchmarks. Use EOS: Document 80% in Trainual ($100/month).

- Map (Month 1): Lucidchart workflows.

- Document (2-3): KPIs (98% OTIF), videos.

- Train: Role-plays; 95% audits.

HVAC-specific: Fault-trees for repairs; van apps. Gains: 30% efficiency for disciplined owners.

Team Building: From Solo to Squad

Shortage of 110,000 techs by 2025 costs 20% revenue. Recruit via schools/LinkedIn; retain with sharing, flex (50% turnover cut). Develop: Reimburse NATE; pods. Counter PE poaching: Equity, huddles.

Margin Mastery: From 10% to 20% Net

Averages 10%; top quartile 20%.

- Pricing: Value-based; 5-10% annual hikes.

- Costs: Consolidate vendors (15% savings); recycle scrap.

- Mix: 50% contracts (55% gross).

- Tech: Automate billing (5% plug).

- Training: Upsells +25% tickets.

Weekly tracks: <50% gross? Materials probe; <15% net? Overhead slash.

Comprehensive FAQ

- How much does it cost to start an HVAC business? Expect $30,000-50,000 minimum, covering tools ($5,000-15,000), vehicle ($15,000-45,000), insurance ($3,000-8,000/year), and reserves. Skimping risks failure; factor state variations. (48 words)

- How long does it take to become profitable? Break-even typically 6-9 months; full profitability (positive cash flow) in 12-18 months with steady leads. First-year revenue $100,000-250,000 is realistic. (42 words)

- Do I need to be a certified technician first? Yes, for credibility and jobs—EPA 608 is essential. Many start certified; it builds trust and qualifies for licenses. Non-techs partner with hires. (41 words)

- What licenses and certifications are required? EPA 608 ($10-150, refrigerant handling), state contractor license ($200-1,000), surety bond ($100-500). Locals add permits. Vary by state—check boards like CSLB. (43 words)

- How much can HVAC business owners realistically make? Averages $107,000/year, but varies: $30,000-50,000 year one, $100,000+ at $1M revenue (5% of sales). Top owners hit $200,000+ at scale. (45 words)

- Is the HVAC industry saturated or is there room for new businesses? Fragmented with 29,000 players; room in underserved areas or niches like retrofits. Competition intense in cities—differentiate via service. (40 words)

- What's the actual failure rate for HVAC startups? Aligns with small biz: 20% year one, 50% five years. HVAC-specific: 70% struggle early due to cash/labor. (38 words)

- Should I buy an HVAC franchise or start independently? Franchises offer branding/support but 5-10% fees limit control; independents provide flexibility but require self-setup. Choose franchise for novices; independent for experienced. (47 words)

- How do I find and hire good technicians? Post on Indeed/Reddit, partner trade schools. Offer $25-35/hour, trials, bonuses. Retention: Profit-sharing, training—addresses 110,000 shortage. (41 words)

- What's a realistic first-year revenue target? $100,000-250,000 for solos, via 50-100 jobs. Focus quality over volume; scale with systems. (32 words)

- How do I compete against established companies? Specialize (e.g., eco-retrofits), leverage reviews/Google, offer guarantees. Niche in locals; 3-5x Ads ROI builds leads. (36 words)

- What insurance do I need? General liability ($941/year avg), workers' comp ($1,500-4,000), auto ($800-2,000). Bundles $75/month; shop Insureon. (33 words)

- Should I specialize (residential vs commercial) or do both? Start residential for quicker cash; add commercial for stability. Both diversifies but strains resources—scale gradually. (35 words)

- How do seasonal fluctuations affect cash flow? Summers peak (60% revenue), winters dip—unreserved leads to 20% failures. Buffer 3 months; 40% recurring mitigates. (36 words)

- When should I hire my first employee? At $150,000-200,000 revenue or 40-50 jobs/month overload. Start apprentices; ensure SOPs ready. (31 words)

Conclusion: Your Path to Sustainable Growth Starts Today

Scaling an HVAC business to seven figures demands resilience, systems, and realistic planning—but the rewards include financial security and industry impact. As stories like Campbell's and Morrell's show, consistent execution turns challenges into opportunities. Audit costs, draft SOPs, secure one lead weekly. While results vary, disciplined owners thrive. What's your next step?

Keywords: start HVAC business guide, scale HVAC company realistically, HVAC startup costs, avoid HVAC business failure.

Reference List

- Entrepreneur.com: Josh Campbell Article (Aug 25, 2025): https://www.entrepreneur.com/growing-a-business/how-this-entrepreneur-went-from-small-business-to-25/496151

- Yelp Business: Rescue Air Article (Aug 20, 2025): https://business.yelp.com/resources/articles/behind-the-review-how-rescue-air-built-a-25-million-one-stop-shop-for-hvac-and-plumbing/

- Commerce Institute: Business Failure Rates (2024): https://www.commerceinstitute.com/business-failure-rate/

- Chamber of Commerce: Small Business Stats (Jul 24, 2024): https://www.chamberofcommerce.org/small-business-statistics/

- GoDuo: HVAC Failure Reasons (Sep 16, 2024): https://www.goduo.co/blog/understanding-why-hvac-businesses-fail-and-how-to-build-a-thriving-company

- Hook Agency: Air Pros Bankruptcy (Mar 21, 2025): https://hookagency.com/blog/why-hvac-companies-fail/

- HVAC Software FAQs: Failed Businesses (Oct 24, 2023): https://hvacsoftwarefaqs.com/faqs/failed-hvac-businesses/

- Energy.gov: HVAC Contractor Market PDF: https://www.energy.gov/eere/better-buildings-neighborhood-program/articles/better-buildings-neighborhood-program-10

- ServiceTitan: Franchise vs Independent (Jun 11, 2024): https://www.servicetitan.com/blog/hvac-franchise

- SkillCat: EPA 608 (2025): https://www.skillcatapp.com/epa-608-certification-online

- Mainstream Engineering: EPA Type I (2025): https://ww2.epatest.com/epa-section-608/openbook/

- SmartService: Startup Costs: https://www.smartservice.com/blog/what-does-it-cost-to-start-an-hvac-company

- Workyard: HVAC Facts 2025 (Sep 4, 2025): https://www.workyard.com/construction-management/hvac-facts-statistics

- ServiceTitan: Owner Salary (Dec 6, 2024): https://www.servicetitan.com/blog/hvac-owner-salary

- ServiceTitan: HVAC Stats (Apr 22, 2025): https://www.servicetitan.com/blog/hvac-statistics

- NEXT: HVAC Insurance (Oct 2025): https://www.nextinsurance.com/business/hvac-insurance/cost/

- Insureon: HVAC Costs (Oct 7, 2024): https://www.insureon.com/installation-business-insurance/hvac-installation/cost

- ServiceTitan: Owner Salary: https://www.servicetitan.com/blog/hvac-owner-salary

- Kasper Associates: Millionaire Class (Oct 14, 2024): https://www.kasperassociates.com/general/americas-new-millionaire-class-plumbers-and-hvac-entrepreneurs/

- Rynoss Podcast: Jim Abrams (Jul 26, 2022, updated 2025): https://rynoss.com/podcast/episode-130-legendary-advice-from-the-hvac-goat-jim-abrams-pt-1/

- Owned and Operated: Andrew Morrell (Feb 13, 2025): https://www.ownedandoperated.com/post/owned-and-operated-169-scaling-an-hvac-startup-to-6m-how-andrew-morrell-went-from-zero-to-millions