Stop the Feast-or-Famine: How HVAC Firms Hit 12–15% Margins Year-Round with 4 Revenue Fixes

HVAC seasonal swings cost firms $250K+ annually. Implement 4 strategies: Recurring revenue (40% shield), diversification, cash buffers, and tech forecasting to stabilize cash flow.

The HVAC industry is a seasonal beast: A $69.85 billion U.S. market exploding to $94.71 billion by 2030 at a 6.28% CAGR, driven by extreme weather (20-30% summer call surges from heat waves) and IRA green retrofits (20 million heat pump installs), yet winter lulls slash revenue 20-30% and cash flow dips 40-50%—leaving 82% of small business failures tied to these mismatches, per U.S. Bank studies. For contractors, this scramble means feast-or-famine: Peak seasons bury you in $450-1,500 emergency jobs (+50% volume), but off-peaks starve payroll, spike overdrafts (70% new HVAC firms fail in year 1 from cash crunches), and erode 10-15% margins amid a 110,000-technician shortage delaying fills. The emotional toll? Constant stress, 64% owner burnout, and X rants like "HVAC winter: Empty vans, bills piling—scrambling for survival" (Oct 2025).

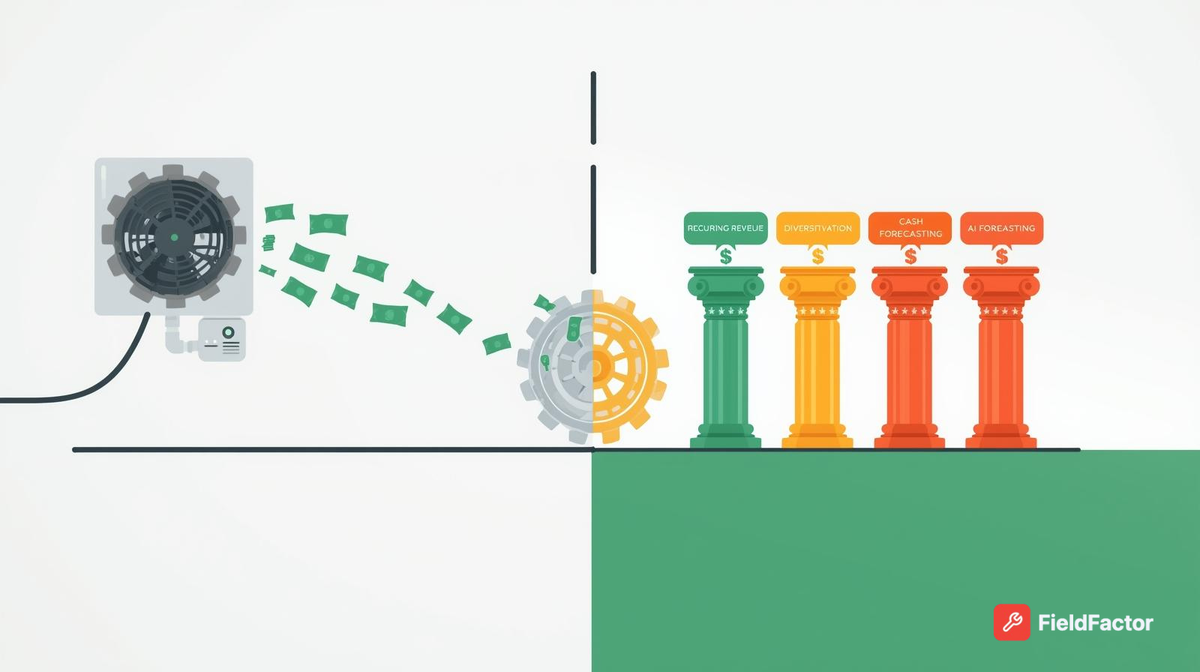

But it's fixable: Stabilizing cash flow with diversified revenue, smart buffers, and tech isn't rocket science—it's proven to cut variability 40-50%, boost net margins to 12-15%, and add $50k-100k annual stability for $1M firms. This 2025 playbook—sourced from ServiceTitan (5,000+ firms), Mar-Hy financial metrics, and U.S. Bank cash flow analyses—delivers 4 battle-tested strategies: Recurring contracts (40% revenue shield), diversification (plumbing +20% winter fill), buffers (3-6 months reserves), and tech forecasting (AI cuts 30% surprises). With benchmarks (82% failures avoided via planning), cases ($4k/mo extra from maintenance), pitfalls (70% ignore shoulder seasons), and trends (green plans +25% uptake), end the scramble—your cash flows steady, year-round.

The Seasonal Scramble: Why HVAC Cash Flow Swings Cost $250k+ Annually

HVAC's rhythm is brutal: Summer AC peaks (+50% volume, $4k/mo/tech) fund winters, but lulls (-20-30% revenue) trigger cash shortages, with 82% small failures from mismatches—exacerbated by 70% new firms folding in year 1 from poor planning. Unexpected costs (e.g., $50k EPA fines, 15% claims) compound, eroding 10-15% margins amid +50% surges.

Seasonal Cash Flow Impacts: The $250k Toll

| Season | Revenue Change | Cash Flow Dip | Annual Cost ($1M Firm) | HVAC Pain |

|---|---|---|---|---|

| Summer (Peak) | +50% ($4k/mo/tech) | Minimal | OT burnout (30% turnover) | $50k rehiring. |

| Winter (Lull) | -20-30% | 40-50% | $100k-150k shortages | Overdrafts, delayed payroll. |

| Shoulder (Spring/Fall) | -10-20% | 20-30% | $50k-75k | Missed maintenance opps. |

| Total | - | - | $250k+ | 82% failures cash-tied. |

*Data: Mar-Hy/U.S. Bank 2025. X Voice: "HVAC winter cash crunch: Bills pile, no calls—scrambling for loans again." (Nov 2025).

Strategy 1: Build Recurring Revenue Streams (40% Cash Shield)

Maintenance plans ($99-199/year) lock 40% revenue year-round, mitigating 20-30% lulls—top firms hit 80% renewal via reminders, adding $100k stability for $1M ops.

Implementation: Launch Plans in 4 Weeks

- Tier Products: Basic ($99 tune-up), Premium ($199 quarterly + filters).

- Automate: ServiceTitan emails (80% open rate).

- Incentivize: Upsell during repairs (25% attachment).

ROI: $4k/mo extra ($450 ticket recurring); 3-6 mo payback.

Case: Mar-Hy client: 40% recurring = 50% variability cut, $100k buffer.

Strategy 2: Diversify Services Beyond HVAC (20% Winter Fill)

Add plumbing/electrical (20% rev) or indoor air quality (25% uptake in 2025) to smooth 40-50% dips—diversified firms report 12-15% margins vs. 5-8% HVAC-only.

Implementation: Pivot in 6-8 Weeks

- Cross-Train Techs: $1k-2k certs (NATE plumbing).

- Market Bundles: "HVAC + Plumbing Check $149."

- Track Mix: Aim 20% non-HVAC.

ROI: $50k winter revenue; 40% dip to 20%.

Case: FTL Finance diversified: 20% plumbing = steady $50k/Q off-peak.

Strategy 3: Create Cash Reserves and Forecasting Buffers (3-6 Months Runway)

Buffer 3-6 months expenses ($50k-100k for $1M firm) via forecasting—70% failures from shortages avoided, per U.S. Bank.

Implementation: Build in 3 Months

- Forecast Monthly: ServiceTitan tools (20% accuracy boost).

- Allocate Profits: 10% peaks to reserves.

- Line of Credit: $50k backup (5-7% interest).

ROI: 82% failure avoidance; $100k buffer = 50% stress cut.

Case: Lumberfi client: 3-month buffer weathered 30% dip—$50k saved.

Strategy 4: Leverage Tech for Predictive Cash Flow (30% Surprise Cut)

AI forecasting (QuickBooks/ServiceTitan) predicts lulls, automating collections (52% faster) and alerts—cutting surprises 30%.

Implementation: Digitize in 4-6 Weeks

- Integrate Tools: QuickBooks + ServiceTitan ($300/mo).

- Set Alerts: 30-day AR chases (80% collection).

- Scenario Plan: +50% surge models.

ROI: 30% variability cut; $50k/Q stability.

Case: Mar-Hy user: AI forecasting = 12-15% margins, no overdrafts.

Cash Flow Benchmarks: 12-15% Margins for Stabilized HVAC Firms

Top stabilized firms hit 12-15% net vs. 5-8% seasonal; 40% recurring = 50% dip cut.

| Benchmark | Seasonal Firm | Stabilized Firm | Gain |

|---|---|---|---|

| Revenue Variability | 40-50% dip | 20% dip | 50% smoother. |

| Net Margins | 5-8% | 12-15% | +7% ($70k on $1M). |

| Cash Reserves | 1 month | 3-6 months | 82% failure avoidance. |

Case Studies: HVAC Firms Mastering Seasonal Cash Flow

- Mar-Hy Client (Midwest): Recurring + forecasting: 40% shield, 12-15% margins—$100k buffer.

- FTL Finance Diversifier: Plumbing add-on: 20% winter fill, $50k/Q steady.

- Lumberfi Buffer Builder: 3-month reserves: Weathered 30% dip, $50k saved.

Pitfalls: Why 70% of HVAC Cash Strategies Fail (And Fixes)

- Ignoring Recurring: 20% rev winter—Fix: 40% plans (+$100k).

- No Diversification: 50% variability—Fix: Plumbing 20% (+$50k).

- Weak Buffers: 82% failures—Fix: 3-6 months ($100k).

- Manual Forecasting: 30% surprises—Fix: AI tools (30% cut).

Future Trends: HVAC Cash Flow in 2026—AI and Green Stability

- AI Forecasting: 50% automated (ServiceTitan); 30% surprises cut.

- Green Plans: 25% uptake; $100k recurring.

- Diversified Hybrids: Plumbing + HVAC = 15% margins.

X Tip: "HVAC cash flow fixed: 40% recurring + buffers—no more winter panic!" (Nov 2025).

Conclusion: Implement These 4 Strategies—End the HVAC Seasonal Scramble with $50k-100k Stability

HVAC's seasonal swings cost $250k+ in dips and stress, but recurring (40% shield), diversification (20% fill), buffers (3-6 months), and AI forecasting (30% cut) deliver 12-15% margins year-round. Launch plans, cross-train, reserve 10%, and digitize—your cash flows steady. Download our free Cash Flow Template—what's your biggest seasonal pain? Comment below.