The Real Reason HVAC Techs Are Burning Out—and How Ethical Shops Can Win

A viral Reddit post from a 26-year HVAC veteran just exposed the industry’s identity crisis—where craftsmanship collides with sales pressure. Here’s what 463 techs really said.

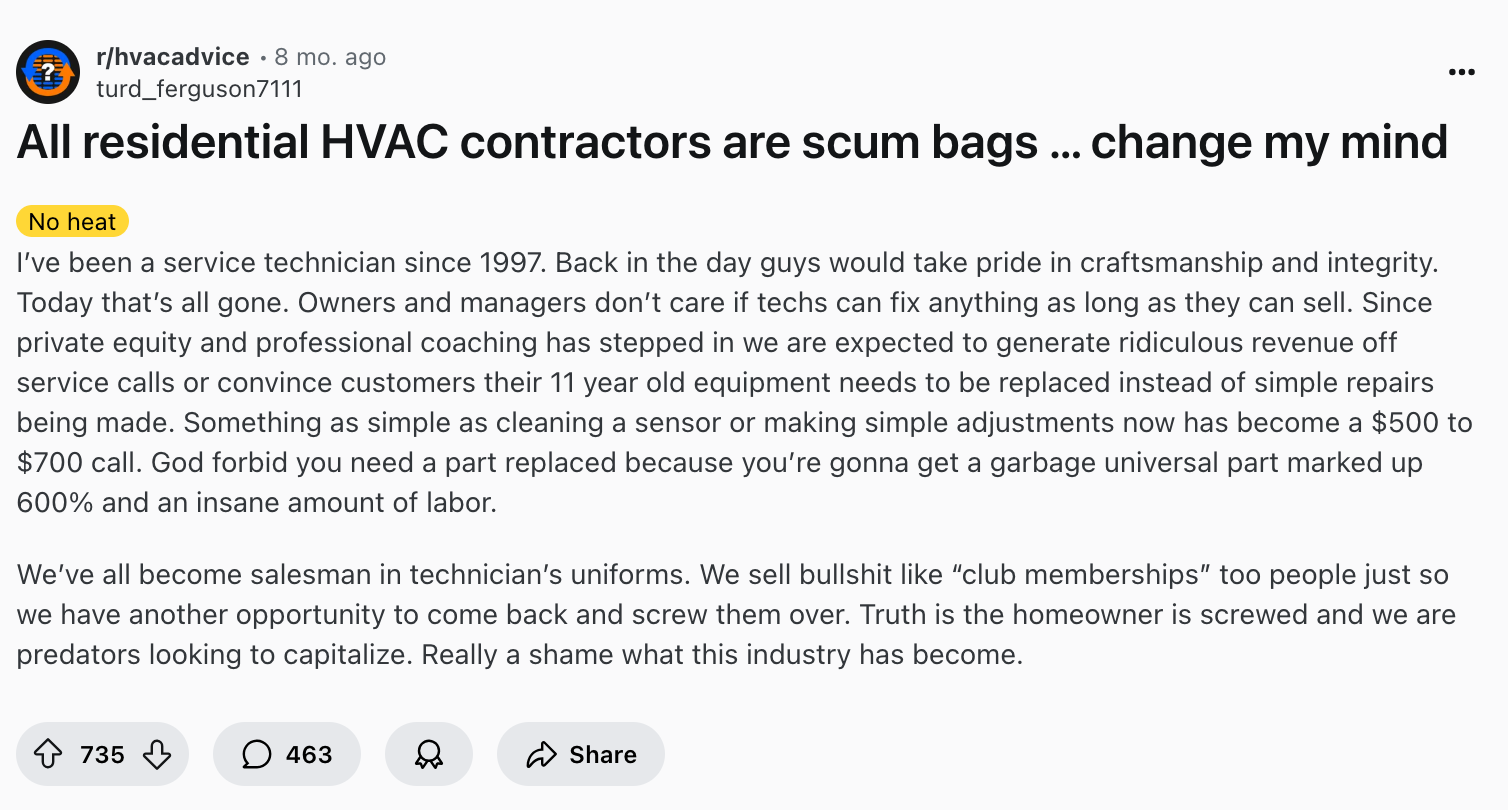

A 26-year HVAC veteran posted this on Reddit eight months ago. It received 735 upvotes and 463 comments—one of the most engaged posts in r/hvacadvice history.

I spent six hours reading every single comment. What I found wasn't just venting. It was a window into an industry at war with itself.

On one side: technicians who entered the trades to fix problems and help people.

On the other: a business model that increasingly demands they become salespeople first, technicians second.

Here's what's actually happening in the trades—and why it matters if you're running or working in a trade business in 2025.

The Post That Struck a Nerve

The original poster had been in HVAC since 1997. His complaint was specific: the industry used to value craftsmanship and integrity. Now it's about sales numbers.

Simple repairs that should cost $50-70 have become $500-700 upsell opportunities. Sensor cleanings turn into system replacement pitches. Basic maintenance becomes a high-pressure sales call.

"We've all become salesmen in technician's uniforms," he wrote.

The post named the culprit: private equity firms and their "professional coaching" programs that prioritize revenue per truck over quality service. His conclusion was stark: "The homeowner is screwed and we are predators looking to capitalize."

The response was immediate and overwhelming. The 463 comments broke into three distinct groups:

Current and former techs saying "This is exactly why I quit the industry."

Small shop owners saying "We're trying to do it right but can't compete."

Homeowners saying "This explains so much about my experiences."

One comment captured the sentiment: "Really a shame what this industry has become."

Three Forces Reshaping Trade Business Culture

Force #1: Private Equity's Playbook

Over the past decade, private equity firms have been buying up local HVAC, plumbing, and electrical companies at an accelerating rate. They bring capital, systems, and scale. They also bring a specific business model.

The model centers on "revenue per truck" metrics. Each service call becomes an opportunity to maximize ticket size. Technicians face mandatory upselling expectations. Commission structures punish honest assessments and reward aggressive sales tactics.

The math works like this: A local independent shop charges $150-200 for a service call and fixes the actual problem. A PE-backed chain offers an $89 diagnostic fee, then presents a $500-1,200 "solution" with 0% financing options.

When customers call three companies for quotes, they often choose based on the diagnostic fee and financing availability—not realizing they're walking into a sales process designed to maximize the final ticket.

From a short-term financial perspective, the model is profitable. Revenues increase. Metrics improve. Investors see returns.

But the model is unsustainable for three reasons: skilled technicians burn out and leave, customer trust steadily erodes, and eventually the economics break down as the talent pool shrinks and reputation damage accumulates.

The problem is that "eventually" can take years. Meanwhile, PE firms continue implementing the same playbook across new acquisitions.

Force #2: The Commodification of Technical Expertise

The shift in identity is subtle but profound. Technicians entered the trades with a specific self-concept: "I'm a skilled professional who solves problems."

The new model requires a different identity: "I'm a revenue generator who happens to know HVAC."

Multiple comments described the pressure to sell unnecessary equipment. A technician can't simply clean a sensor—they must pitch a full system replacement. Performance reviews evaluate average ticket size, not work quality or customer satisfaction. One commenter noted: "God forbid you need a part replaced because you're gonna get a garbage universal part marked up 600%."

This creates psychological conflict for technicians who chose the trades specifically because they wanted to:

- Solve tangible problems

- Work with their hands

- Help people directly

- Be valued for technical expertise

Instead, they're now expected to:

- Maximize every service call

- Sell club memberships and maintenance plans

- Push financing options

- Manufacture urgency about equipment condition

The result is predictable: the technicians who are best at the actual work often leave the industry. The ones who thrive are those comfortable with aggressive sales tactics—which may not correlate with technical skill.

One former tech summarized it: "I loved HVAC. I hated being a used car salesman."

Force #3: The Competitive Trap

An honest shop charges fair prices. The customer thinks it's too expensive. They call a PE-backed competitor who offers a "free diagnostic." They get sold a $2,000 solution with 0% financing. The honest shop loses the job.

One commenter runs a 30-year shop. He treats his technicians well, charges fair prices, and keeps customers happy. His pricing is 30-40% less than the large PE-backed firms in his area. He's profitable.

He's also struggling to compete—not because his service is inferior, but because he doesn't play the financing and upselling game. He looks "less professional" compared to the slick marketing of consolidated competitors.

This creates an impossible choice for ethical shop owners:

- Play the game (and become what you're competing against)

- Don't play (and watch market share erode to aggressive competitors)

- Exit the industry (which many are choosing)

The trap isn't just about individual business decisions. It's a systemic shift in how the industry operates, and resisting it requires both conviction and creative strategy.

What the Data Shows

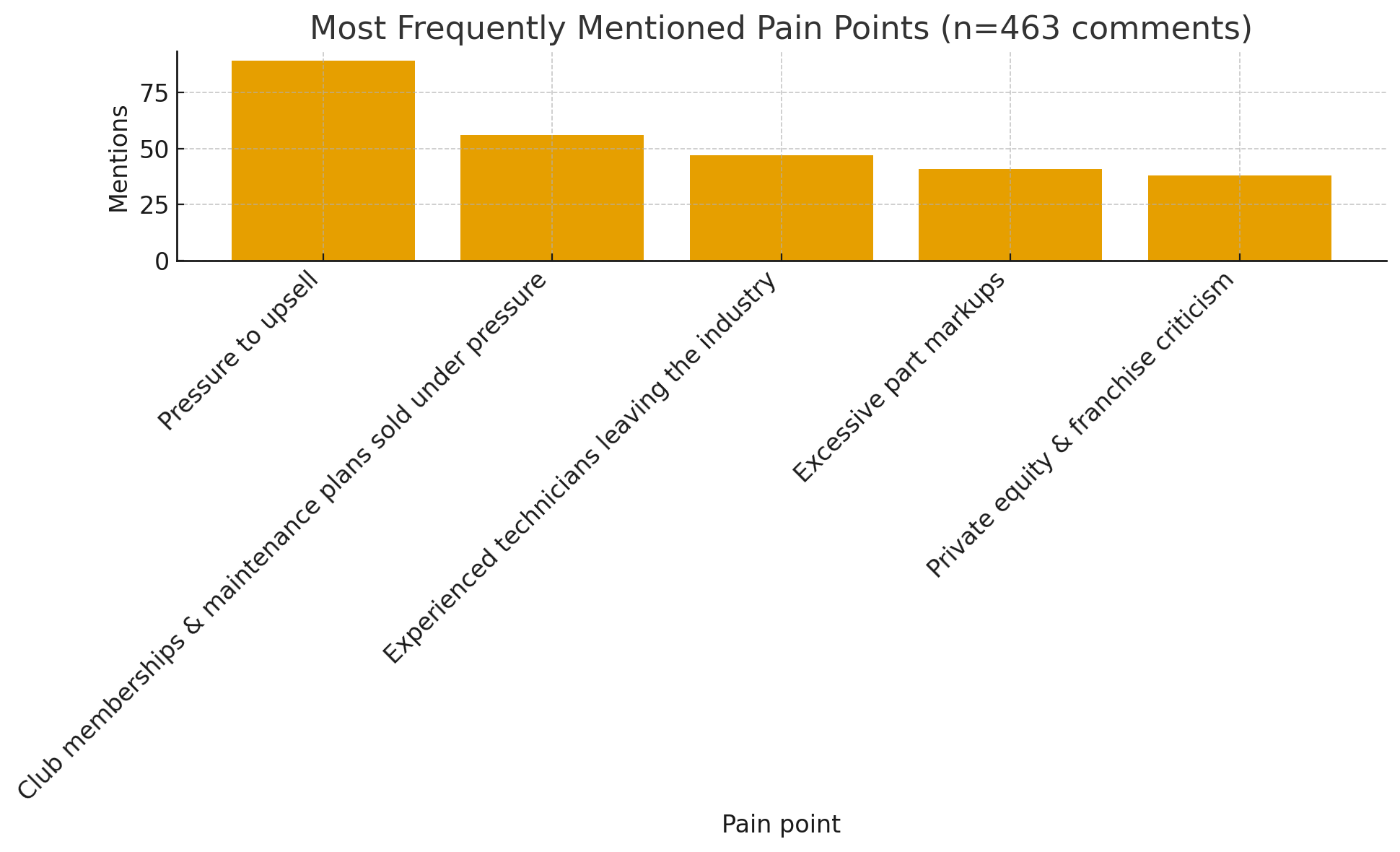

I categorized all 463 comments by type and sentiment. Here's what emerged:

Sentiment breakdown:

- 67% from current or former technicians expressing frustration with industry changes

- 18% from small shop owners describing similar competitive challenges

- 12% from homeowners validating these experiences

- 3% defending the sales-oriented approach

Most frequently mentioned pain points:

- Pressure to upsell (mentioned 89 times)

- Club memberships and maintenance plans sold under pressure (56 times)

- Experienced technicians leaving the industry (47 times)

- Excessive part markups (41 times)

- Private equity and franchise criticism (38 times)

Two distinct groups dominated the discussion:

"This is why I quit" camp: Technicians with 10-30 years of experience who left for other trades, industrial work, or different careers entirely. They miss the technical work but couldn't tolerate what the job had become.

"We're doing it right but drowning" camp: Small shop owners with 1-10 technicians who are trying to compete ethically but losing bids to firms with bigger marketing budgets, financing options, and aggressive sales training.

The second group's challenge is particularly acute: they prove it's possible to run an ethical, profitable trade business. But they're exceptions, not the rule—and their competitive position is weakening.

Four Uncomfortable Truths

Truth #1: The "Scumbags" Are Currently Winning

The shops implementing aggressive sales tactics are growing faster. They have better marketing budgets, financing options customers want, professional sales training, and polished branding.

The honest shops are struggling in comparison. They can't afford extensive marketing. They don't offer financing. Their technicians are technical experts, not trained salespeople. They often look "less professional" than consolidated competitors.

This isn't a moral judgment—it's a market reality. The question is whether this advantage is sustainable or whether it's eroding the foundation of customer trust the industry depends on.

Truth #2: Customer Behavior Enables the Problem

From the comments, customer decision-making often reinforces problematic practices:

- Choosing the lowest diagnostic fee (then facing hard sales tactics)

- Prioritizing financing availability over total cost or service quality

- Responding to urgency tactics ("Your heat exchanger is cracked and dangerous")

- Leaving negative reviews for honest but higher quotes

- Rewarding polished sales presentations over technical expertise

This creates a feedback loop. Shops that invest in sales training and financing options win more jobs, which funds further investment in sales and marketing, which wins more jobs.

There's a caveat: customers face a genuine trust problem. When everyone has 5-star reviews and professional marketing, how do you identify the honest contractor? The market has made it increasingly difficult to distinguish between quality service and effective sales tactics.

Truth #3: Ethical Business is Possible But Harder

The 30-year shop owner in the thread proves the model works: fair pricing, well-treated technicians, satisfied customers, prices 30-40% below PE-backed competitors, and still profitable.

But he's an exception for specific reasons:

- 30 years of reputation and customer relationships

- Not pursuing aggressive growth

- Willingness to have slower periods

- Established customer base that refers others

- Market position built before PE consolidation accelerated

New shop owners entering the market today face a different competitive landscape. Building the same position requires patience and capital that many don't have access to.

Truth #4: This Extends Beyond HVAC

Comments identified the same dynamics in plumbing, electrical, auto repair, and appliance repair.

The pattern appears consistent: when an industry involves technical work that customers don't fully understand, when fear and urgency can be manufactured, when financing options are available, and when private equity has entered the market—these dynamics emerge.

This suggests the issue isn't unique to HVAC culture but rather represents a broader shift in how service industries are being restructured.

What Can Actually Be Done?

If you're running a trade business and want to maintain quality and ethics while remaining competitive, here are five strategies that commenters and successful shop owners have validated:

Strategy 1: Own the "Anti-Sales" Position

Make transparency and honesty your explicit brand position:

- Display pricing information publicly

- Explain your "no unnecessary upselling" policy prominently

- Show your work (before and after photos, explanations of what you did and why)

- Highlight customer reviews that specifically mention your honesty

- Use marketing language like "We could have sold you X, but here's what you actually need"

This works because there is a market segment actively looking for honest contractors—they're just hard to find. If you make honesty your clear differentiator, you attract customers who value that specifically.

These customers typically have higher lifetime value, refer more frequently, and are less price-sensitive because they're buying trust, not just service.

Strategy 2: Build Trust Before the Service Call

The traditional model makes the first interaction a high-pressure situation: a problem needs solving, money needs to be spent, and decisions need to be made quickly.

An alternative approach uses content and education:

- Publish blog posts explaining common issues in plain language

- Create videos showing what quality work looks like

- Offer email newsletters with maintenance tips that help people whether they hire you or not

- Provide free resources that demonstrate your expertise

This shifts the dynamic. By the time someone calls you, they already know you, trust your expertise, and are pre-qualified as customers who value quality over the lowest price.

The close rate on these customers is significantly higher, and they're less likely to price shop because they've already made the decision about who they want to work with.

Strategy 3: Subscription Models Done Right

Many customers do want maintenance plans and prefer predictable annual costs. The issue isn't the concept—it's the high-pressure sales tactics and inflated pricing.

A well-designed subscription model:

- Offers transparent value (specific services included, clear pricing)

- Prices fairly ($150-300/year rather than $900+)

- Sells itself based on simple math and convenience

- Never feels mandatory or pressured

- Actually delivers the promised value

This creates predictable revenue, improves customer retention, and provides a legitimate service that customers appreciate—without the negative associations of forced upselling.

Strategy 4: Compete on Reliability and Service Quality

PE-backed firms win on brand recognition, financing options, and marketing budget. Small shops can't match these advantages directly.

But you can win on operational execution:

- Actually showing up on time

- Doing exactly what you said you'd do

- Answering the phone promptly

- Following up after service

- Being available for emergencies

- Remembering customer history and preferences

Multiple comments expressed frustration that it's become difficult to find contractors who simply do these basic things reliably. If you execute well on fundamentals, you create differentiation that larger, more systematized competitors often struggle to match.

Strategy 5: Align Compensation with Quality

The PE model typically uses commission structures tied to ticket size. This directly incentivizes upselling.

An alternative compensation approach:

- Base pay on salary or hourly rates (at fair market rates)

- Bonuses tied to customer satisfaction scores and reviews mentioning specific technicians

- Bonuses for low callback rates (indicating quality work)

- Annual profit sharing

This attracts technicians who left larger companies due to sales pressure, improves work quality since compensation isn't tied to upselling, reduces turnover, and turns technicians into advocates for your brand rather than viewing customers as sales opportunities.

The Bigger Question

This Reddit thread captures an industry at an inflection point.

One path leads toward full commodification: continued PE consolidation, sales culture dominating, the best technicians exiting, customer trust eroding, and eventually either regulatory intervention or market correction.

The other path involves a counter-movement: small and medium shops that refuse to adopt aggressive sales models, building brands explicitly around honesty and technical expertise, using content and community to find customers who value quality, paying technicians well without sales pressure, accepting slower growth in exchange for sustainability.

Which path wins?

The answer likely isn't binary. Both models will probably coexist, segmenting the market by customer type and price sensitivity. But the long-term stability of the aggressive sales model depends on sustained customer trust—and that appears to be eroding.

For shop owners and technicians making decisions today, the choice isn't really about which model will "win." It's about which model you're willing to be part of building.

Conclusion

The technician who titled his post "All residential HVAC contractors are scum bags" doesn't actually believe all contractors are unethical. He's mourning what his industry has become.

He remembers when being an HVAC technician meant taking pride in craftsmanship, helping people solve real problems, being valued for technical expertise, and making a good living doing honest work.

Now he's being asked to prioritize sales over service.

After reading 463 comments, three things became clear:

There are still ethical contractors. They're just being drowned out by better-funded competitors.

There are technicians who care about quality work. They're just leaving the industry because the culture has shifted.

There are customers who value honesty. They just can't reliably identify who to trust.

The industry isn't broken yet. But it's being broken by specific, identifiable forces. Which means it can potentially be fixed—or at minimum, there's room for businesses that explicitly reject the problematic model.

That starts with shop owners who refuse to compromise on ethics and then build businesses that prove there's a better way.

FAQ: HVAC Sales Culture in 2025

Q1. Why are so many homeowners seeing big replacement pitches after ‘free’ diagnostics?

Because some chains optimize for revenue-per-truck: low entry fee → high-ticket, financed solution.

Q2. Are maintenance plans always a rip-off?

No. Transparent plans ($150–$300/yr with clear inclusions) deliver value; the issue is pressure and inflated pricing.

Q3. Is it still possible to run an ethical, profitable shop?

Yes—operators win by competing on reliability, education, and compensation aligned to quality (not ticket size).

Q4. Why are good techs leaving?

Identity clash: craftspeople measured by sales KPIs (avg ticket, memberships) burn out and exit.

Q5. What should customers look for to avoid upsell traps?

Upfront pricing, clear scope, photographed work, no “today-only” urgency, and reasonable plan pricing.