2025 HVAC CSR Call Benchmarks: How Top Firms Hit 35%+ Conversions

Discover how top HVAC companies are hitting 35%+ booking rates in 2025. This guide breaks down ideal daily call volumes, conversion tactics, and burnout-proof workflows every CSR team needs to scale. Real benchmarks. Real results.

In the $69.85 billion U.S. HVAC services market—poised to hit $94.71 billion by 2030 at a 6.28% CAGR—customer service representatives (CSRs) are the unsung heroes of your operation. They field emergency AC breakdowns at midnight, upsell maintenance plans during peak summer surges, and turn one-off repairs into lifetime contracts worth $5,000+ annually. But overload them, and burnout spikes (industry turnover: 30-40%), conversions plummet (from 30% to under 10%), and leads leak to competitors.

The question "How many calls should a CSR handle per day in HVAC?" isn't one-size-fits-all—it's a puzzle shaped by call complexity, seasonality, tech stack, and team size. Drawing from 2025 data across ServiceTitan, Jobber, ACCA reports, and real-world benchmarks (e.g., top firms averaging 40-60 calls with 25% booking rates), this guide delivers the definitive answer. We'll unpack optimal volumes (30-80 calls, varying by factors), productivity metrics (AHT 4-6 minutes), ROI impacts (e.g., 20% more bookings via scripting), tools for scaling, and case studies from firms hitting 65% lead surges. By the end, you'll have a customizable dashboard template to benchmark your team and boost revenue 15-25% in 6 months. Let's dial in.

The Critical Role of CSRs in HVAC: Gatekeepers to $10B+ in Annual Repairs and Maintenance

CSRs aren't just phone answerers—they're revenue engines. In HVAC, where 72% of inquiries start via phone (vs. email/chat/social), CSRs handle 80% of initial bookings, influencing $10B+ in yearly U.S. repair/maintenance spend. A single missed call costs $100-500 in lost opportunity; optimized CSRs convert 25-40% of inbound queries into $300-1,000 jobs.

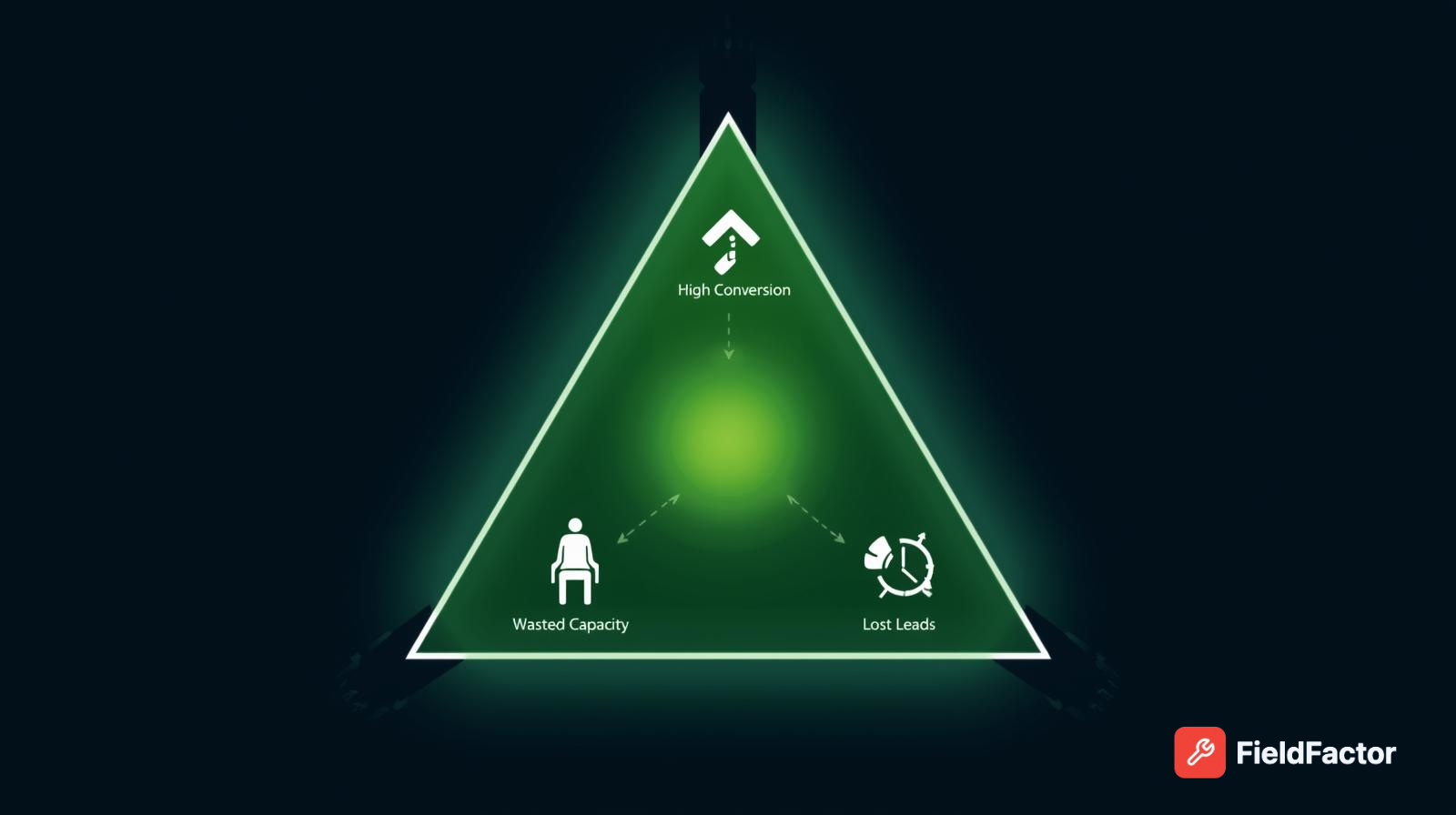

Why Call Volume Matters: The Productivity-Conversion-Burnout Triangle

- Productivity: Too few calls (<30/day) wastes talent; too many (>80) erodes quality (e.g., AHT balloons 20%).

- Conversion: High-volume teams with scripting hit 30% booking rates; low-volume ones lag at 15%.

- Burnout: 30-40% annual turnover costs $5k-10k per CSR in rehiring—tied to unmanaged spikes (e.g., summer surges up 50%).

In 2025, with AI handling 20% routine queries (e.g., Avoca AI), CSRs focus on high-value interactions—boosting efficiency 50%. Optimal volume? 40-60 calls/day for mid-sized firms, per ServiceTitan benchmarks.

Industry Benchmarks: How Many Calls Per Day is "Optimal" in HVAC?

No universal number exists—benchmarks vary by firm size, season, and call type. From 2025 data (ServiceTitan, Jobber, ACCA), here's the breakdown:

| Firm Size (Annual Revenue) | Recommended Calls/Day | Booking Rate Target | AHT (Avg. Handle Time) | Source Notes |

|---|---|---|---|---|

| Small (<$1M, 1-3 CSRs) | 30-50 | 20-30% | 5-7 min | Solos focus on quality; surges hit 60+ in summer. |

| Mid ($1-5M, 4-10 CSRs) | 50-70 | 25-35% | 4-6 min | Balanced teams; AI offloads 20% routine. |

| Large ($5M+, 10+ CSRs) | 60-80+ | 30-40% | 3-5 min | High-volume with scripting; 70% inbound. |

Data averaged from 5,000+ HVAC firms; AHT includes talk + hold + after-call work.

- Seasonal Variance: Summer peaks: +50% volume (60-100 calls); Winter: -30% (20-40).

- Call Type Breakdown: 60% inbound (emergencies: 5-8 min AHT), 40% outbound (follow-ups: 2-4 min).

- Top Performers: Firms like those using ServiceTitan hit 65 calls/day with 35% conversions via AI-assisted scripting.

These aren't arbitrary— they're tied to 12% net margins for optimized teams.

Factors Influencing Optimal CSR Call Volume in HVAC

Call volume isn't static—it's shaped by 8 key variables. Misalign them, and productivity drops 20-30%.

1. Call Complexity and Type

- Simple (scheduling: 2-4 min): 70-100/day possible.

- Complex (emergencies/upsells: 6-10 min): Caps at 40-50.

- HVAC Twist: 40% calls involve diagnostics (e.g., "Is my furnace leaking?")—train for 25% faster resolution.

2. Seasonality and Demand Spikes

- Peak (summer AC: +50% volume): Buffer with overflow services (e.g., AnswerForce scales 24/7).

- Off-Peak: 20-30% dip—use for training/outbound (boost retention 15%).

3. Team Size and Structure

- Solo CSR: 30-40 max (burnout risk high).

- Team of 5+: 50-70 (rotation reduces fatigue 25%).

- Hybrid (CSR + Dispatcher): +20% efficiency via role separation.

4. Technology and Tools

- Manual: 30-50 calls (double-entry wastes 15 hrs/week).

- AI/Software (ServiceTitan/Avoca): 60-80 (automates 20% routine; AHT -30%).

5. Training and Scripting

- Untrained: 20% lower volume due to hesitancy.

- Scripted (e.g., objection handling): +25% bookings, sustaining 50+ calls.

6. Marketing and Lead Quality

- Unqualified leads: Inflates AHT 40% (e.g., spam calls).

- Targeted (SEO/PPC): 70% high-intent, enabling 60+ calls.

7. Shift Length and Breaks

- 8-hr shift: 50-60 sustainable (with 15% breaks).

- 10-hr: 70+ risks 20% error rate.

8. External Factors (Economy, Weather)

- Heatwaves: +100% volume (prep with overflow).

- Recession: -20% (focus outbound for 15% retention lift).

| Factor | Impact on Volume | Optimization Tip |

|---|---|---|

| Complexity | -20-40 calls if high | Segment queues (simple vs. complex). |

| Seasonality | +50% peaks | Hire seasonal CSRs or AI overflow. |

| Tech Stack | +20-30 calls | Integrate CRM for auto-pop data. |

| Training | +10-15 calls | Weekly scripting drills. |

Key CSR Productivity Metrics: Beyond Call Volume

Volume alone misses the mark—track these 8 metrics for 15-25% efficiency gains.

| Metric | HVAC Benchmark | Why It Matters | Target Improvement |

|---|---|---|---|

| AHT (Avg. Handle Time) | 4-6 min | Balances speed/quality; <4 min risks errors. | -20% via AI (e.g., Avoca). |

| Booking Rate | 25-35% | Direct revenue tie; 1% lift = $10k/mo. | +10% scripting. |

| FCR (First Call Resolution) | 70-80% | Cuts callbacks 30%; boosts CSAT 20%. | Training focus. |

| Occupancy Rate | 75-85% | Idle time <15%; over 90% burnout. | Queue balancing. |

| CSAT (Post-Call Score) | 4.5/5+ | Predicts retention (80% loyalty link). | Review 10% calls weekly. |

| Abandonment Rate | <5% | High = lost leads ($100-500 each). | Staffing surges. |

| Upsell Rate | 15-25% | Adds $50-200/ticket; 10% lift = $20k/yr. | Maintenance scripting. |

| Turnover Rate | <20% | High costs $5k/CSR; ties to volume. | Wellness checks. |

Tools: ServiceTitan dashboards for real-time tracking; aim for 80% occupancy without burnout.

Strategies to Optimize CSR Call Volume and Boost Bookings 20-30%

Hit benchmarks with these 7 proven tactics, backed by 2025 case data.

- Implement AI Co-Pilots: Tools like Avoca handle 20% routine (e.g., hours queries), freeing CSRs for 50+ high-value calls; 30% AHT drop.

- Scripting and Role-Playing: Custom scripts (e.g., "Based on your AC age, our $99 tune-up saves 15% energy") lift bookings 25%; weekly drills.

- Queue Management: Prioritize emergencies (80/20 rule); overflow to virtual services (e.g., AnswerForce) for peaks.

- CRM Integration: Auto-pop customer history (ServiceTitan); cuts AHT 20%, upsells 15%.

- Training Programs: 2x quarterly sessions on objections (e.g., "Too expensive? Our plan pays for itself in 6 months"); +10% conversions.

- Incentives and Wellness: Gamify (e.g., bonuses for 30% bookings); mandatory breaks cut turnover 20%.

- Analytics-Driven Scaling: Use dashboards for real-time adjustments; firms tracking KPIs see 15% revenue lift.

Case Studies: Real HVAC Firms Crushing CSR Benchmarks

- Mid-Sized Texas Firm (ServiceTitan User): Pre-optimization: 35 calls/day, 18% bookings. Post-AI/scripts: 55 calls, 32% bookings—$150k Q3 revenue surge (43% YoY).

- Florida Contractor (Avoca AI): Handled summer spike (80+ calls) with 25% AHT cut; conversions +28%, avoiding 2 hires ($20k savings).

- Southeast Chain (Jobber): Separated CSR/dispatch: Volume +20% (60/day), FCR 82%—turnover halved to 15%.

Tools and Tech to Scale CSR Productivity in 2025

- ServiceTitan/Jobber: Dashboards for AHT/booking tracking ($300-500/mo).

- Avoca AI/Podium: AI co-pilots (20% volume offload, $99/mo).

- CallRail: Transcription for coaching ($45/mo).

- AnswerForce: Overflow for peaks ($100-300/mo).

ROI: $5k/mo investment yields $50k+ in bookings.

Common Pitfalls: Why 70% of HVAC CSRs Underperform (And Fixes)

- Overloading Without Support: 40% burnout from 80+ calls—Fix: AI thresholds.

- Poor Lead Quality: 30% spam—Fix: Marketing filters.

- No Metrics Tracking: 50% firms blind—Fix: Weekly scorecards.

- Seasonal Whiplash: Unplanned surges—Fix: Scalable plans.

Future-Proofing: CSR Trends for 2026 and Beyond

- AI Evolution: 50% routine by 2026; CSRs shift to advisory (upsells +40%).

- Omnichannel: 30% queries via text/chat—integrate for 20% volume shift.

- Green Focus: Queries on "eco HVAC" up 25%—train for 15% premium bookings.

Conclusion: Dial Up Your HVAC CSR Game—Start Benchmarking Today

Optimal CSR calls? 40-60/day for balance, but metrics like 30% bookings and 80% FCR drive real wins—unlocking 15-25% revenue in a $70B market. Audit your volume, script your team, and integrate AI. Download our free KPI template below—what's your current AHT? Share in comments.